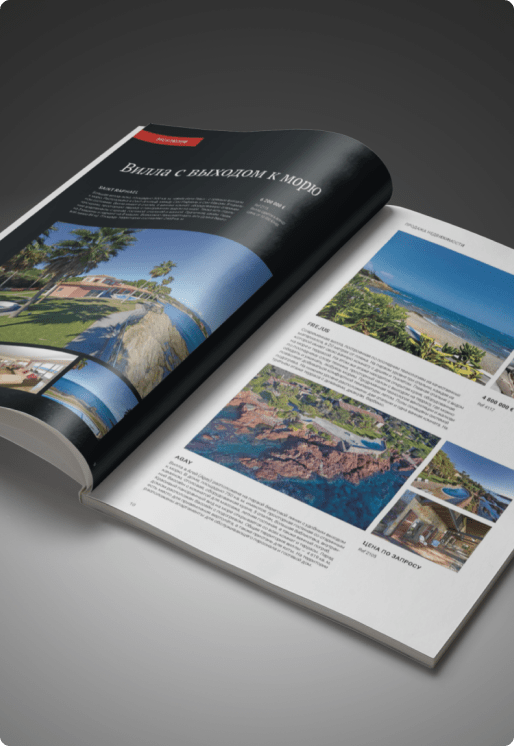

French Riviera Real Estate

Property ServiceAzur showcases a wide-ranging collection of luxury real estate across the stunning Côte d’Azur. From prestigious homes and upscale apartments to commercial properties and prime building plots, our portfolio caters to a variety of tastes and preferences. Our expert team provides comprehensive support in administrative and fiscal matters, ensuring a seamless real estate experience. Whether you're seeking a sea-view apartment, an opulent villa, a grand estate, or exclusive commercial real estate, we offer a diverse selection to fulfill your desires.

Learn more about the company

Property ServiceAzur showcases a wide-ranging collection of luxury real estate across the stunning Côte d’Azur. From prestigious homes and upscale apartments to commercial properties and prime building plots, our portfolio caters to a variety of tastes and preferences. Our expert team provides comprehensive support in administrative and fiscal matters, ensuring a seamless real estate experience. Whether you're seeking a sea-view apartment, an opulent villa, a grand estate, or exclusive commercial real estate, we offer a diverse selection to fulfill your desires.

Learn more about the company

Take a look at our list of frequently asked questions about buying property on the French Riviera